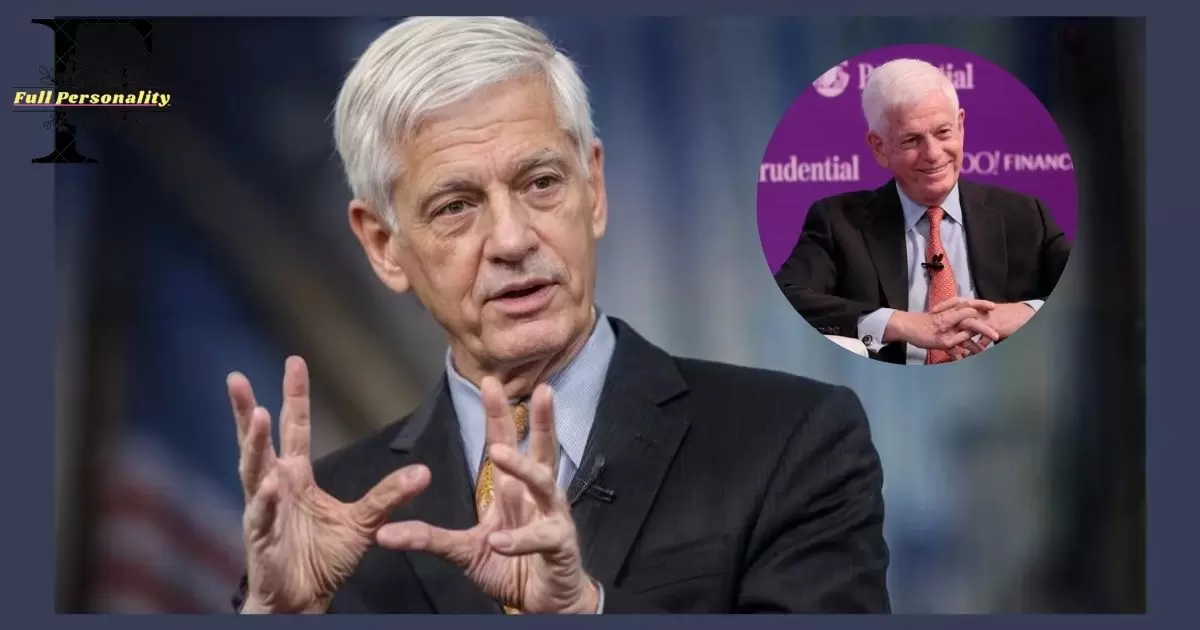

In the high-stakes world of finance, few names carry as much weight and intrigue as Marc Gabelli. Born into a family synonymous with investment acumen, Marc has carved out his path in the industry, marked by both impressive achievements and notable controversies. This article delves into the life, career, and impact of Marc Gabelli, exploring the various facets that have shaped his reputation in the financial sector.

Early Life and Education: The Foundations of a Financial Career

Marc Gabelli’s journey began on November 20, 1968, born into a family deeply rooted in the world of finance. As the son of Mario Gabelli, a renowned value investor and founder of GAMCO Investors, Marc was exposed to the intricacies of the financial markets from an early age. This upbringing laid the groundwork for his future career, instilling in him a passion for investment and a keen understanding of market dynamics.

You may want to Read: Kase Abusharkh Amy Berry: A Journey of Innovation and Impact

Recognizing the importance of a strong educational foundation, Marc pursued his higher education at prestigious institutions. He earned his Bachelor’s degree in Economics from Harvard University, a choice that reflected his commitment to understanding the theoretical underpinnings of finance and economics.

This academic background would prove invaluable in his future endeavors, providing him with the analytical skills and knowledge base necessary to navigate the complex world of investment management.

The Early Years at GAMCO: Learning the Ropes

Following his graduation, Marc Gabelli took his first steps into the professional world by joining GAMCO Investors, the investment firm founded by his father. This decision was not merely a case of nepotism but rather a strategic move to learn from one of the industry’s best. At GAMCO, Marc immersed himself in the day-to-day operations of a successful investment firm, gaining hands-on experience in portfolio management, market analysis, and client relations.

During these formative years, Marc demonstrated a natural aptitude for identifying investment opportunities and a willingness to learn from both successes and setbacks. His early career at GAMCO was marked by rapid growth and increasing responsibilities, as he quickly proved his worth beyond his family name. This period was crucial in shaping Marc’s investment philosophy, which would later become a hallmark of his professional identity.

Rising Through the Ranks: Leadership at GAMCO

As Marc Gabelli gained experience and honed his skills, he began to take on more significant roles within GAMCO Investors. His ascent through the company ranks was swift but earned, with each promotion reflecting his growing expertise and contributions to the firm’s success.

You may want to Read: Brook B Taube – Entrepreneur, Investor and Philanthropist

Marc eventually held various senior positions, including President and Managing Director, roles that placed him at the forefront of the company’s strategic decision-making processes.

Under Marc’s leadership, GAMCO experienced significant growth and diversification. He played a key role in expanding the firm’s global footprint, introducing new investment products, and adapting to the evolving landscape of the financial industry. His tenure at GAMCO was characterized by a blend of his father’s value investing principles and his innovative approaches, creating a dynamic that propelled the firm to new heights.

Investment Philosophy: The Gabelli Approach

Throughout his career, Marc Gabelli has been known for his adherence to value investing principles, a strategy he inherited and refined from his father’s teachings. This approach focuses on identifying undervalued companies with strong fundamentals and significant growth potential. Marc’s investment philosophy is built on the pillars of thorough research, long-term commitment, and a deep understanding of market dynamics.

You may want to Read: Noel J. Mickelson’s Exposed: The Untold Story (2024 Deep Dive)

What sets Marc apart is his ability to adapt these traditional value investing principles to modern market conditions. He has demonstrated a knack for identifying emerging trends and technologies, allowing him to position GAMCO and his investments ahead of market shifts. This blend of classic value investing with forward-thinking strategies has become a hallmark of Marc Gabelli’s approach to wealth management.

Expanding Horizons: Ventures Beyond GAMCO

While GAMCO Investors has been central to Marc Gabelli’s career, his influence extends far beyond a single firm. Over the years, he has diversified his professional portfolio by taking on board memberships and leadership roles in various companies across different sectors. These positions have included roles in telecommunications, media, technology, and other industries, reflecting Marc’s broad interests and expertise.

One notable venture is his involvement with Teton Advisors, Inc., where he serves as Chief Executive Officer and Director. This position has allowed Marc to apply his investment strategies in a different context, further solidifying his reputation as a versatile financial leader.

Additionally, his role as Chairman and Co-Chief Executive Officer of LGL Group, Inc. demonstrates his ability to guide companies in specialized sectors, in this case, electronic components and instruments.

Marc’s international ventures are equally impressive. He holds positions such as President and Chief Executive Officer at Gabelli Value for Italy SpA and Co-Chairman at Gabelli Merger Plus+ Trust Plc, showcasing his global perspective and ability to operate in diverse financial markets. These roles not only contribute to his wealth but also expand his influence and expertise on a global scale.

The Controversy: SEC Charges and Legal Battles

Despite his numerous achievements, Marc Gabelli’s career has not been without controversy. In 2008, the U.S. Securities and Exchange Commission (SEC) filed a civil fraud action against Marc and Bruce Alpert, the Chief Operating Officer of Gabelli Funds LLC. The charges were related to an undisclosed market timing arrangement with Folkes Asset Management (later known as Headstart Advisers Ltd.) in the Gabelli Global Growth Fund.

You may want to Read: Unlocking Creativity: Advanced Car Illustration Techniques

The SEC’s complaint alleged that from September 1999 to August 2002, Marc Gabelli authorized Headstart to engage in market timing trades within the fund. This practice, which involves short-term buying and selling of mutual fund shares to exploit pricing inefficiencies, was allegedly allowed for Headstart while other investors were being rejected. The arrangement was purportedly sweetened when Marc authorized Headstart to triple its timing capacity in exchange for an investment in a hedge fund he also managed.

The controversy deepened with allegations that neither Marc nor Alpert disclosed this arrangement to the fund’s Board of Directors. Instead, they allegedly assured the Board that market timers were being excluded from the fund. This lack of transparency raised serious questions about fiduciary duty and ethical conduct in fund management.

The SEC charged Marc Gabelli with aiding and abetting violations of Sections 206(1) and 206(2) of the Investment Advisers Act of 1940. These charges highlighted the seriousness of the allegations, as they pertained to fraud and breach of fiduciary duty, core ethical principles in investment management.

Resolution and Aftermath

The legal battle that ensued was protracted and complex. It wasn’t until August 1, 2011, that a resolution was reached. The United States District Court for the Southern District of New York entered a final judgment in the case. While the specific terms of the judgment for Marc Gabelli were not detailed in the provided information, the case’s resolution marked a significant moment in his career.

In a related administrative proceeding, Gabelli Funds LLC, without admitting or denying the SEC’s findings, agreed to a settlement. The firm was censured, ordered to cease its securities law violations, and required to pay a total of $16 million, including disgorgement, prejudgment interest, and penalties. This settlement, while not directly involving Marc Gabelli, undoubtedly had implications for the firm’s reputation and operations.

You may want to Read: How2Invest – Interactive Tools, Comprehensive Guides for

The controversy and its resolution serve as a stark reminder of the ethical challenges and regulatory scrutiny faced by those in positions of financial leadership. It also highlights the complexities of managing mutual funds and the potential conflicts of interest that can arise in the investment world.

Rebuilding and Moving Forward

In the years following the SEC case, Marc Gabelli has worked to rebuild his reputation and continue his career in finance. His ability to maintain leadership positions and secure new roles in various financial entities suggests a level of resilience and continued trust from certain sectors of the industry.

Marc’s post-controversy career has seen him diversify his interests and take on roles that extend beyond traditional fund management. His involvement in companies like PMV Consumer Acquisition Corp., where he serves as Chairman and chief executive Officer, demonstrates his venture into new areas of finance, including special purpose acquisition companies (SPACs).

Furthermore, his continued association with educational institutions and philanthropic organizations, such as his membership on the board of the Institute of International Education, Inc., indicates an effort to contribute positively to society beyond the realm of finance.

The Marc Gabelli Net Worth: A Testament to Financial Acumen

As of 2024, Marc Gabelli’s net worth is estimated to be approximately $600 million. This substantial wealth is a testament to his financial acumen and successful career, despite the setbacks he has faced. His net worth is derived from multiple sources, reflecting the diversified nature of his career and investments.

A significant portion of Marc’s wealth comes from his leadership roles at various investment firms, including his positions at GAMCO Investors and Teton Advisors. These roles typically come with substantial compensation packages, including salaries, performance bonuses, and stock options.

Marc’s investments also contribute significantly to his net worth. As an experienced investor, he maintains a diverse portfolio that includes equities, real estate, and alternative assets. His investment strategy, rooted in value investing principles but adapted to modern market conditions, has likely played a crucial role in growing his wealth.

Additionally, Marc’s board memberships and consultancy work provide additional income streams. These positions often come with lucrative compensation packages and offer opportunities to influence strategic decisions across various industries.

Philanthropy and Social Responsibility

Beyond his professional endeavors, Marc Gabelli has shown an interest in philanthropy and social responsibility. While specific details of his charitable activities are not extensively documented in the provided information, his involvement with educational institutions and international organizations suggests a commitment to giving back to society.

His board membership at the Institute of International Education, Inc. indicates an interest in promoting international understanding through educational exchange. Such involvement aligns with a broader trend among financial leaders to engage in educational philanthropy, recognizing the role of education in shaping future generations of leaders and innovators.

The Gabelli Legacy: A Family Affair

Marc Gabelli’s career cannot be fully understood without acknowledging the influence of his father, Mario Gabelli. Mario, a renowned value investor and founder of GAMCO Investors, has been a significant figure in the investment world for decades. His approach to value investing and his success in building GAMCO into a major investment firm have undoubtedly shaped Marc’s career path and investment philosophy.

The father-son dynamic in the Gabelli family business adds an intriguing layer to Marc’s professional story. While benefiting from his father’s mentorship and the opportunities provided by the family business, Marc has also faced the challenge of establishing his own identity in the finance world. His expansion into roles beyond GAMCO and his handling of the SEC controversy demonstrate his efforts to carve out his legacy within the broader Gabelli name.

Looking to the Future: Marc Gabelli’s Ongoing Impact

As Marc Gabelli continues his career in finance, his influence on the investment world remains significant. His experience, both positive and controversial, provides valuable lessons for aspiring financiers and established professionals alike. The blend of traditional value investing principles with adaptability to modern market trends positions him as a bridge between old-school financial wisdom and contemporary investment strategies.

Marc’s ongoing involvement in various financial ventures suggests that his story in the world of finance is far from over. As markets evolve and new challenges emerge, his approach to investment and business leadership will likely continue to adapt and influence the industry.

Conclusion

Marc Gabelli’s journey in the financial world is a testament to the complexities and challenges faced by those at the highest levels of investment management. His story is one of inherited legacy, personal achievement, controversy, and resilience.

From his early days learning the ropes at GAMCO to his current status as a multifaceted financial leader, Marc’s career offers insights into the dynamics of family businesses in finance, the importance of adapting investment strategies to changing markets, and the ongoing need for ethical vigilance in fund management.

While the SEC case remains a significant part of his professional history, Marc Gabelli’s ability to maintain a prominent position in the finance world speaks to both his skills as an investor and the enduring power of the Gabelli name. His estimated net worth of $600 million in 2024 is a clear indicator of his financial success, despite past controversies.

FAQs

Who is Marc Gabelli?

Marc Gabelli: Financial virtuoso and GGCP director. He’s a key player at Associated Capital Group and Gabelli, showcasing his expertise as a Senior Portfolio Manager. His leadership shone during GAMCO’s IPO and ACG’s public offering.

Who is the CEO of Gabelli Funds?

Mario J. Gabelli: Investment legend with Italian roots. He’s the visionary behind GAMCO Investors, blending financial acumen with philanthropy. His Bronx upbringing adds a touch of grit to his Wall Street success story.

What do Gabelli funds do?

Gabelli Funds: A financial powerhouse offering diverse investment solutions. They’re masters of value and growth equity, with a socially conscious twist. From mutual funds to customized accounts, Gabelli covers all bases in the investment world.

Hello, I’m Rizwan Ullah, the founder of Full Personality. With a background in SEO and three years of experience, I’ve always been fascinated by the ever-changing world of blogging. Full Personality is my platform to delve into the future of blogging. When not exploring tech trends, I focus on SEO and SERPs. I believe in building a community that shares ideas and stays ahead in innovation. Join me on this exciting journey!